Investing in the stock market can seem daunting, but Exchange Traded Funds (ETFs) offer a accessible way to gain exposure to broad market indices like the S&P 500. These funds mirror the performance of a selection of 500 leading corporations, providing investors with a balanced portfolio.

An S&P 500 ETF offers several pros over buying single shares. Firstly, ETFs provide diversification by owning shares in multiple sectors. Secondly, they are generally cheaper to buy and sell than actively managed mutual funds. Thirdly, ETFs trade on stock exchanges, allowing for more convenient transactions.

For investors looking to participate in the growth of the U.S. equity market, S&P 500 ETFs offer a appealing investment option. Selecting the right ETF requires considering factors such as expense ratios, performance deviations, and financial objectives.

High-Yielding S&P 500 ETFs for Your Portfolio

When seeking your portfolio, diversifying options within the S&P 500 can be a strategic move. These ETFs offer exposure to leading US companies, making them a popular choice for traders. Certainly, not all S&P 500 ETFs are created equal. Some consistently surpass the market, offering substantial returns to investors.

- For instance, consider the iShares Core S&P 500 ETF (IVV). These ETFs are known for their reduced expense ratios and strong history.

- Moreover, you could investigate sector-specific S&P 500 ETFs if you have more targeted exposure. Considerably, the Vanguard Information Technology ETF (VGT) focuses on the digital sector, which has historically shown robust growth.

Ultimately, choosing the best S&P 500 ETFs for your portfolio depends on your individual investment goals, risk tolerance, and investment strategy.

Unlocking Market Potential: How to Invest in S&P 500 ETFs

Gaining exposure within the robust and influential S&P 500 index has become exceptionally accessible for investors of various experience levels. This is primarily due to the emergence of Exchange Traded Funds (ETFs) that track the performance of this celebrated market benchmark. Investing in S&P 500 ETFs presents {aattractive avenue for individuals seeking towards build a well-diversified portfolio and participate in the growth potential of the U.S. equities market.

One of the fundamental advantages of ETFs is their convenience. They can be readily acquired through online brokerage accounts, making it effortless for investors to contribute capital to this market segment.

Furthermore, ETFs typically offer reduced expense ratios compared to actively managed mutual funds, meaning that investors retain {ahigher proportion of their returns over the long term.

Before undertaking on an investment journey, it is crucial to execute thorough research and evaluate your risk tolerance. Consider consulting with a financial advisor who can offer personalized guidance tailored to your specific circumstances.

Unlocking Growth with S&P 500 ETFs

Seeking to cultivate a robust and diversified portfolio? Look no further than broad market Exchange-Traded Funds (ETFs) that track the illustrious Nasdaq Composite. These investment vehicles offer an unparalleled opportunity to gain exposure to a vast array of prominent businesses across diverse fields. By investing in an S&P 500 ETF, you're essentially allocating in the very heartbeat of the U.S. economy, allowing you to leverage on its long-term growth potential.

- Streamlining your portfolio construction has never been easier with ETFs.

- Reduce your risk by spreading investments across multiple companies and sectors.

- Achieve consistent returns over time through the power of market capitalization-weighted indexing.

Examining the Pros and Cons of S&P 500 ETFs vs. Individual Stocks

When venturing into the realm of investing, savvy investors often find themselves considering a crucial decision: whether to embark on individual stocks or leverage S&P 500 ETFs. Both avenues offer unique perspectives, and the optimal choice hinges on an investor's risk tolerance. S&P 500 check here ETFs provide a widespread approach, encompassing a portfolio of 500 leading U.S. companies. This instant access to a broad market segment reduces risk comparatively to individual stock selection, which possesses inherent risks due to its focused nature. Conversely, individual stocks offer the potential for exceptional returns if an investor can successfully identify high-performing companies. However, this strategy also requires more detailed research and monitoring. Ultimately, the best methodology lies in thoroughly aligning your investment actions with your personal financial objectives.

Venturing into the S&P 500: Choosing the Right ETF for You

Investing in the S&P 500 is a popular approach for building long-term wealth, but with numerous exchange-traded funds (ETFs) available, selecting the ideal one can be daunting. To optimize your returns and align with your investment aspirations, consider these essential factors. First, identify your risk tolerance; are you comfortable with swings or seeking a more balanced portfolio? Next, evaluate the ETF's expense ratio, as even small differences can impact your overall gains over time.

- Additionally, explore the ETF's underlying holdings to ensure they correspond with your investment ideals. Some ETFs may specialize in certain sectors or themes, while others offer a broad market exposure. Finally, don't forget to assess the ETF's track record and consider its liquidity.

Via carefully considering these factors, you can navigate the S&P 500 landscape and select an ETF that meets your unique investment needs.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Mara Wilson Then & Now!

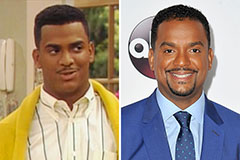

Mara Wilson Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!